Trust Foundation Honesty: Building Rely On Every Task

Trust Foundation Honesty: Building Rely On Every Task

Blog Article

Securing Your Properties: Depend On Structure Experience within your reaches

In today's complex economic landscape, guaranteeing the safety and security and growth of your properties is critical. Depend on foundations work as a keystone for guarding your riches and heritage, giving a structured method to asset defense. Expertise in this world can supply very useful guidance on navigating legal complexities, making the most of tax performances, and creating a durable monetary plan tailored to your distinct demands. By using this specialized understanding, individuals can not just safeguard their possessions efficiently but also lay a solid foundation for lasting wealth preservation. As we explore the ins and outs of trust fund foundation experience, a globe of opportunities unravels for fortifying your economic future.

Value of Depend On Structures

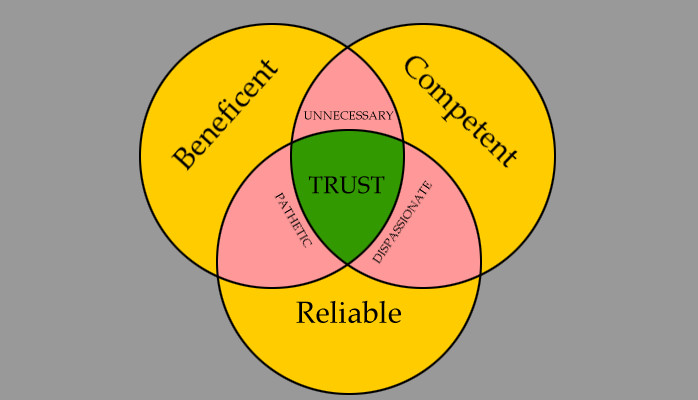

Count on structures play an important role in developing credibility and fostering solid connections in different expert setups. Depend on foundations offer as the foundation for honest decision-making and clear interaction within organizations.

:max_bytes(150000):strip_icc()/land-trust.asp-final-62434e1dd78a4eaaae6b6b3a531c82a2.png)

Benefits of Expert Advice

Structure on the foundation of count on expert connections, seeking expert advice uses very useful advantages for people and companies alike. Professional support offers a wide range of expertise and experience that can assist navigate complex financial, legal, or tactical difficulties effortlessly. By leveraging the competence of experts in different fields, individuals and organizations can make informed decisions that straighten with their goals and goals.

One significant advantage of professional support is the capability to accessibility specialized expertise that might not be easily available or else. Specialists can provide understandings and viewpoints that can result in ingenious remedies and possibilities for development. In addition, collaborating with specialists can help minimize risks and uncertainties by offering a clear roadmap for success.

Moreover, specialist advice can conserve time and sources by enhancing processes and staying clear of costly errors. trust foundations. Specialists can provide customized recommendations customized to certain needs, guaranteeing that every choice is knowledgeable and tactical. Generally, the benefits of professional advice are multifaceted, making it a beneficial property in safeguarding and maximizing assets for the long-term

Ensuring Financial Safety And Security

In the world of economic planning, securing a steady and thriving future rest on critical decision-making and sensible financial investment selections. Making sure financial security involves a diverse technique that includes various facets of wide range management. One essential component is producing a varied investment portfolio tailored to specific risk tolerance and monetary goals. By spreading investments throughout different possession classes, such as supplies, bonds, realty, and products, the danger of substantial economic loss can be reduced.

Additionally, preserving an emergency fund is crucial to secure against unexpected expenditures or earnings interruptions. Professionals suggest establishing apart 3 to 6 months' worth of living costs in a fluid, click for source quickly accessible account. This fund serves as a financial safeguard, supplying comfort during stormy times.

On a regular basis evaluating and readjusting financial strategies in response to altering conditions is likewise critical. Life occasions, market changes, and legal adjustments can affect financial security, highlighting the value of continuous evaluation and adaptation in the quest of long-lasting monetary safety and security - trust foundations. By executing these methods thoughtfully and constantly, people can strengthen their monetary ground and job in the direction of an extra safe and secure future

Safeguarding Your Assets Effectively

With a strong foundation in location for economic security with diversity and emergency situation fund upkeep, the following critical step is protecting your possessions properly. One reliable approach is property appropriation, which entails spreading your financial investments across different asset classes to minimize danger.

Additionally, establishing a trust can use a secure way to secure your assets for future generations. Counts on can aid you control exactly how your properties are dispersed, minimize estate tax obligations, and safeguard your riches from lenders. By applying these approaches and seeking specialist guidance, you can secure your possessions effectively and protect your economic future.

Long-Term Property Security

To guarantee the enduring protection of your wealth versus prospective threats and unpredictabilities over time, critical planning for lasting possession defense is vital. Lasting asset security involves applying steps to guard your possessions from different dangers such as financial slumps, lawsuits, or unforeseen life occasions. One important element of lasting asset security is establishing a count on, which can use significant advantages in securing your properties from lenders and legal disagreements. By moving ownership of properties to a depend on, you can go to the website secure them from potential threats while still preserving some level of control over their management and circulation.

Additionally, diversifying your financial investment portfolio is an additional vital strategy for lasting possession protection. By spreading your financial investments across various property classes, industries, and geographical regions, you can minimize the influence of market changes on your total wide range. Furthermore, routinely evaluating and upgrading your estate strategy is important to make certain that your possessions are shielded according to your wishes in the lengthy run. By taking a positive method to lasting property protection, you can guard your riches and give monetary safety and security for yourself and future generations.

Conclusion

To conclude, depend on structures play a vital duty in safeguarding properties and guaranteeing monetary safety. Specialist advice in developing and taking care of trust structures is important for long-term asset security. By using the experience of professionals in this area, people can successfully guard their possessions and prepare for the future with self-confidence. Trust fund structures give a strong structure blog here for safeguarding wide range and passing it on to future generations.

Report this page